Product design for a employee focused financial wellness app

- My role

- User research, prototyping and UI design. Product strategy. Builted and mantained a design system.

- Results

- 70+ Clients (companies) and more than 5.500 active users. More than R$ 15 million borrowed and customer satisfaction above 88%.

In the early years of the company, our goal was to develop services that helped people solve financial emergencies. However, we faced challenges such as finding ways to help people get out of debt, understanding the context of those in debt, and investigating how we could assist people in making better financial decisions.

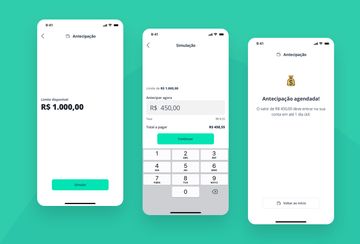

Salary advance

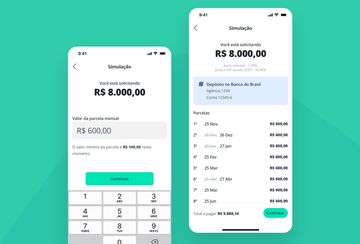

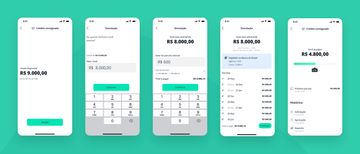

Payroll loan

Savings

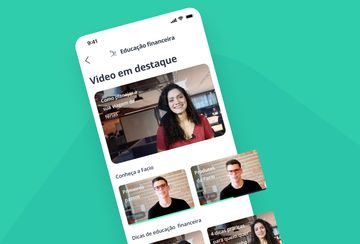

Financial education

Process

The first service offered was salary advance. Using it, employees could advance up to 35% of the amount they were to receive and it would be deducted from their paycheck the following month.

Then, we began a continuous cycle of customer interviews (with partner company employees) to understand their needs and we identified four main patterns:

- Financial emergencies

- Some people do not have access to credit and need extra money when a financial emergency occurs, such as paying a bill, buying medicine, or shopping at the supermarket.

- Debts with abusive interest rates

- Others have debts with high interest rates and would like to exchange these debts for lower interest payments.

- People starting to save

- Others have recently balanced their finances and are looking for incentives to save.

- Dealing with money

- Finally, companies had the need to ensure that their employees knew how to balance their finances, since financial well-being is directly linked to productivity.

We developed four services to meet these needs and tested each idea in interviews, usability tests, and value tests, iterating when necessary.

Whenever possible, we used a GoPro camera for in-person interviews and tests

Research

Customer interviews, usability, and value testing were part of the routine of the responsible teams during the discovery and delivery process.

Until the beginning of 2020, we conducted the research in-person at the office where the company was located. After the start of the pandemic, we adapted this process for online execution.

User experience

Assisting the customer in making the best decisions with minimal cognitive effort has always been one of the pillars for building interfaces.

These are some examples of feature and product decisions taken in this direction:

Avoding high debts

When we are in debt or going through some financial scarcity, we tend to make worse decisions. To help people in this situation, in the payroll loan product, we created a loan simulation that calculates the total paid based on how much the person can afford monthly.

You can access the prototype of this simulation, used in usability and value tests.

When the user chooses the amount to pay monthly, we recalculate the total to be paid. That way, the customer makes the operation that fits in their budget

Accessibility

Ensuring that people can use the services on their smartphones was essential for the product’s success.

An example of an initiative to make the interface more accessible is the use of controls known to users. For example: we avoid the common practice of using sliders for value selection since this option requires more detailed motor control from the user.

Typing a value into a field is more accessible than dragging an element across the interface

System icons

Our customer’s use journey started in their company’s internal communication. From there, the person discovered that they could use Facio, visited the website, and downloaded the app.

To keep communication on such a complex topic efficient regardless of the channel, we used specific icons for each functionality, service, or status.

All icons use a 24dp grid and follow the same stroke pattern

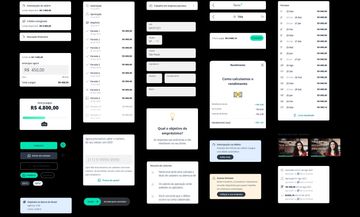

Design system

In order to maintain consistency and streamline the design-to-development handover process, I have created a modular design system that revolves around reusable components and their various states. These components include cards, list items, and controls. By employing this system, each component can be effortlessly rearranged and seamlessly integrated with others, all while upholding design consistency and preserving familiar UI patterns for the user.

The complex nature of the app required a design system to facilitate the creation of experiments with new functionalities.

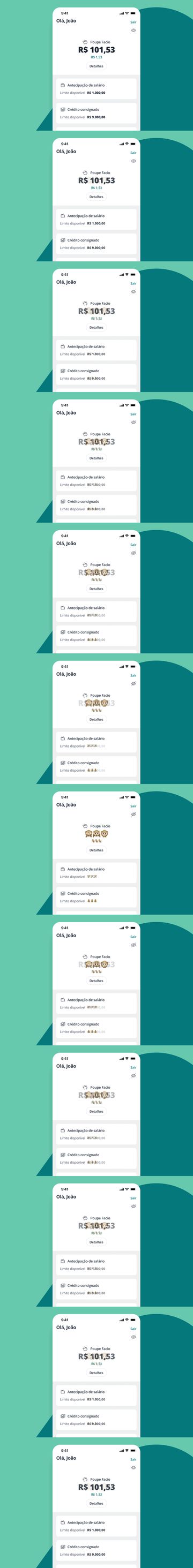

Privacy

Privacy is essential for those making financial decisions because, in many cases, this information is extremely sensitive and personal.

We believe that it is a fundamental right that must be protected and respected to ensure the financial security and freedom of each person.

Hiding the available values was a common customer request

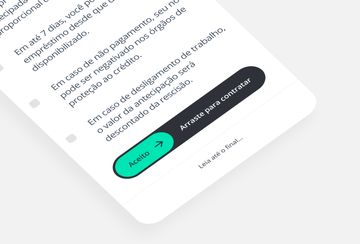

Signature

To replicate the need to sign a paper document in an app, we used a “Slide to unlock” style button. This interaction was sufficient to seal the deal for transactions with Facio’s banking partners, being simple and enjoyable.

When taking out a loan, the final step is the acceptance of terms

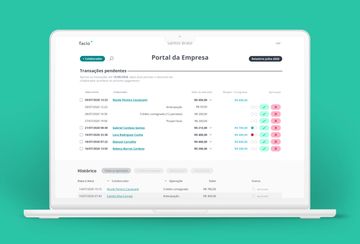

Company Portal

At a certain point, it was necessary to explore and build a platform so that companies could independently manage employees with access to the benefit.

This functionality involved notifications, communication, management, and display of each employee’s status, as well as performing all actions in bulk.

To scale the service, it was necessary to give more capacity to HR workers and the personal department of partner companies

Results

- 70+ companies

- 5,500+ clients

- 88% customer satisfaction

- R$ 15 million borrowed

- 6,000+ financial emergencies resolved

B2B financial wellness services were discontinued in early 2022. While customers were satisfied with using the product, few companies were interested in offering this service to their employees, which led Facio to pivot its product to the B2C market.

Role

In these products, I was responsible for creating interfaces, interviewing and conducting usability tests with clients, creating content, and measuring satisfaction with the service.